FREE CASH FLOW TO EQUITY FREE

If a student is well versed with calculating free cash flows, the inclusion of preferred equity will not make much of a difference.Discounted cashflow (DCF) valuation views the intrinsic value of a security as the present value of its expected future cash flows. The adjustments that need to be made to the standard process of calculating free cash flows are very intuitive and minor. To sum it up, preferred equity is a fairly common mode of financing used by companies. Once again, we need to consider the net change in the position of preferred equity if the firm is issuing more shares and repurchasing the old ones simultaneously. Adjust Net Borrowing: Just like we made adjustments for debt while calculating free cash flow to equity, similarly we need to make adjustments to preferred equity as well.Īll repayments need to be subtracted from the free cash flow to equity whereas any cash raised by new issue of preferred shares must be added to the cash flows.However, there is another adjustment that is specific to the calculation of free cash flow to equity. This is because free cash flow to equity is discounted at cost of equity. However, we must not use adjustment number two. While calculating free cash flow to equity, we have to use adjustment number one mentioned above i.e. Now, since there are three different modes of financing with three different costs, obviously our WACC will be the weighted average of all the three modes! Calculating Free Cash Flow to Equity (FCFE): Earlier we used to calculate WACC using only two components i.e. Adjust The Weighted Average Cost of Capital (WACC):Also, the rate at which we discount the free cash flows has to be modified when we include preferred debt.Hence the entire amount paid as preferred dividend simply needs to be added back to the cash flows to derive the free cash flow of the firm. In case of preferred dividends, there is no tax shield. However, we usually reduce the interest tax shield from the interest amount. Add Back Preferred Dividends: Along with interest, we will also add back preferred dividends while calculating the free cash flow available to the firm.The only difference lies in the following adjustments: The procedure to calculate the free cash flow to the firm (FCFF) remains the same. Lets discuss these modifications: Calculating Free Cash Flow to Firm (FCFF): This makes it necessary to make certain modifications while calculating the free cash flow due to equity as well as to the firm. In simple words, preferred shares are not tax deductible. It is for this reason that any compensation paid to the preferred shareholders is not considered as an expense for tax purposes. However, legally preferred shares are considered to be a part of equity. However, there is a subtle difference between the treatments of interest paid on debt and dividends paid on preferred shares. Preferred Dividends Are Not Tax Deductible: The similarity to debt makes this assumption realistic.

This is because they have a fixed rate of return and in most circumstances companies will end up paying the dividend that is fixed on them. Preferred Shares: Treated Like Debt:Īs far as the cash flows are concerned preferred shares must be treated like debt. In this article, we will concentrate on how preferred shares affect the calculation of free cash flows. However, it is not mandatory for the company to pay this fixed dividend if there is no profit in the current year. Just to refresh your memory, preferred shares behave partly like debt and partly like equity. One of the commonly used modes is preferred shares. In real life, many hybrid modes of finance can possibly be used. However, this is not how it works in real life.

It helps us form a basic understanding of how free cash flows work. This assumption is good in the theoretical world. We assumed that there are only two classes of funds available to the firm, this is equity and debt. However, while conducting this analysis we made an implicit assumption.

FREE CASH FLOW TO EQUITY HOW TO

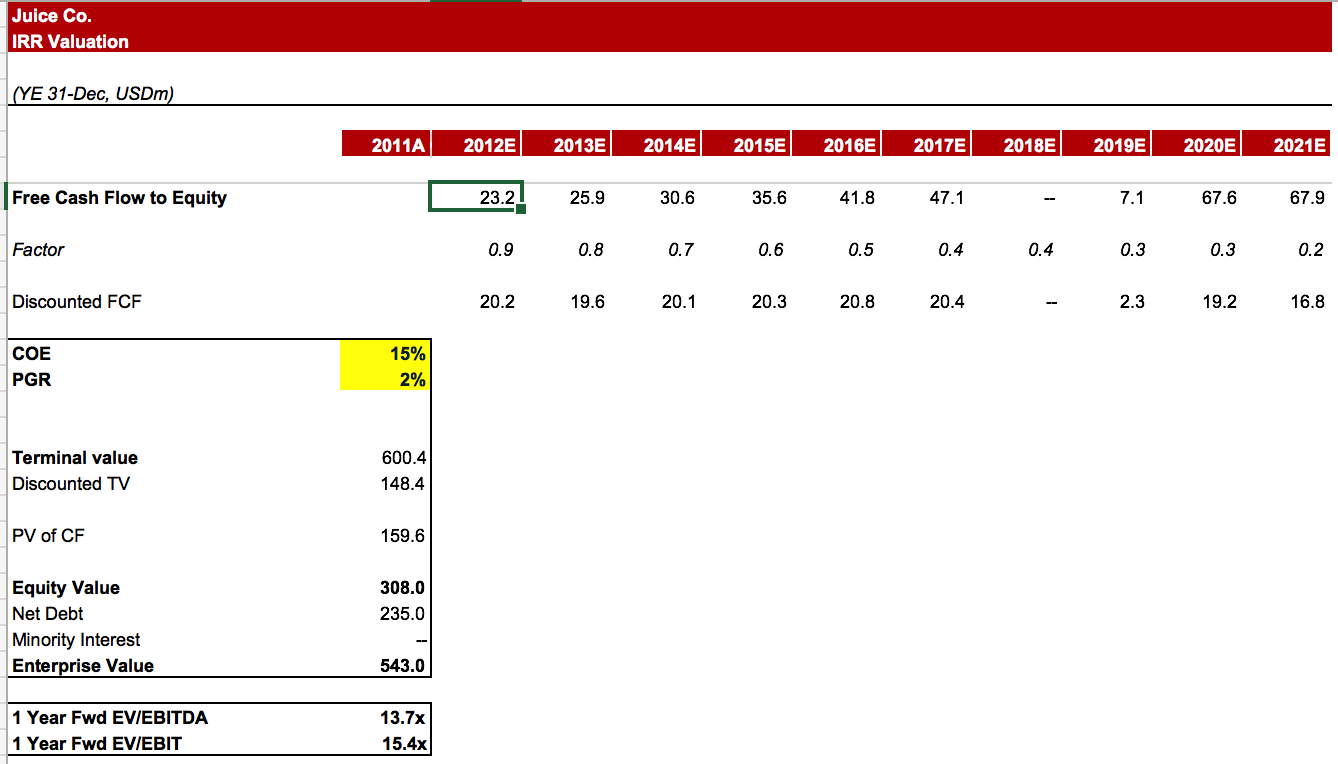

In the previous few articles we understood how to calculate free cash flows which accrue to the firm as a whole as well as to equity shareholders.

0 kommentar(er)

0 kommentar(er)